Incoterms

The meaning of it is that the recipient takes the goods from the premises of the supplier, it can be a store, warehouse, etc. The supplier does not bear any obligations, except for the shipment of goods. All costs are borne by the recipient. EXW is not intended for the transport of goods to the EU. EXW is not used if the recipient is not able to export independently. EXW is for domestic traffic. EXW condition is used to transport goods by any means of transport

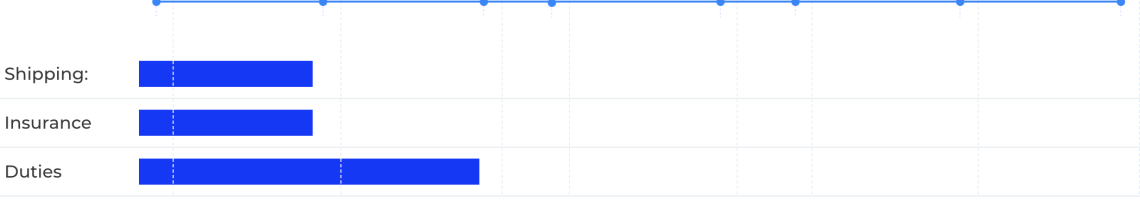

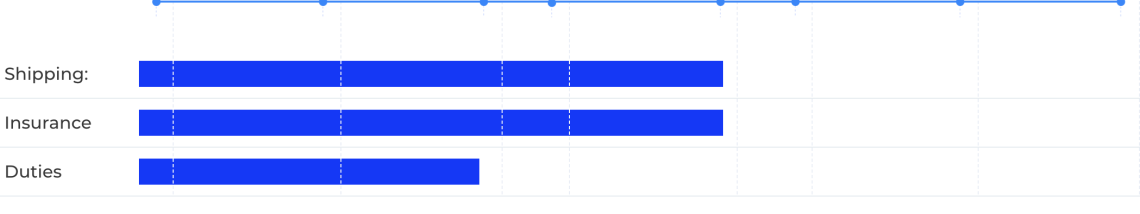

Who covers the logistics charges?

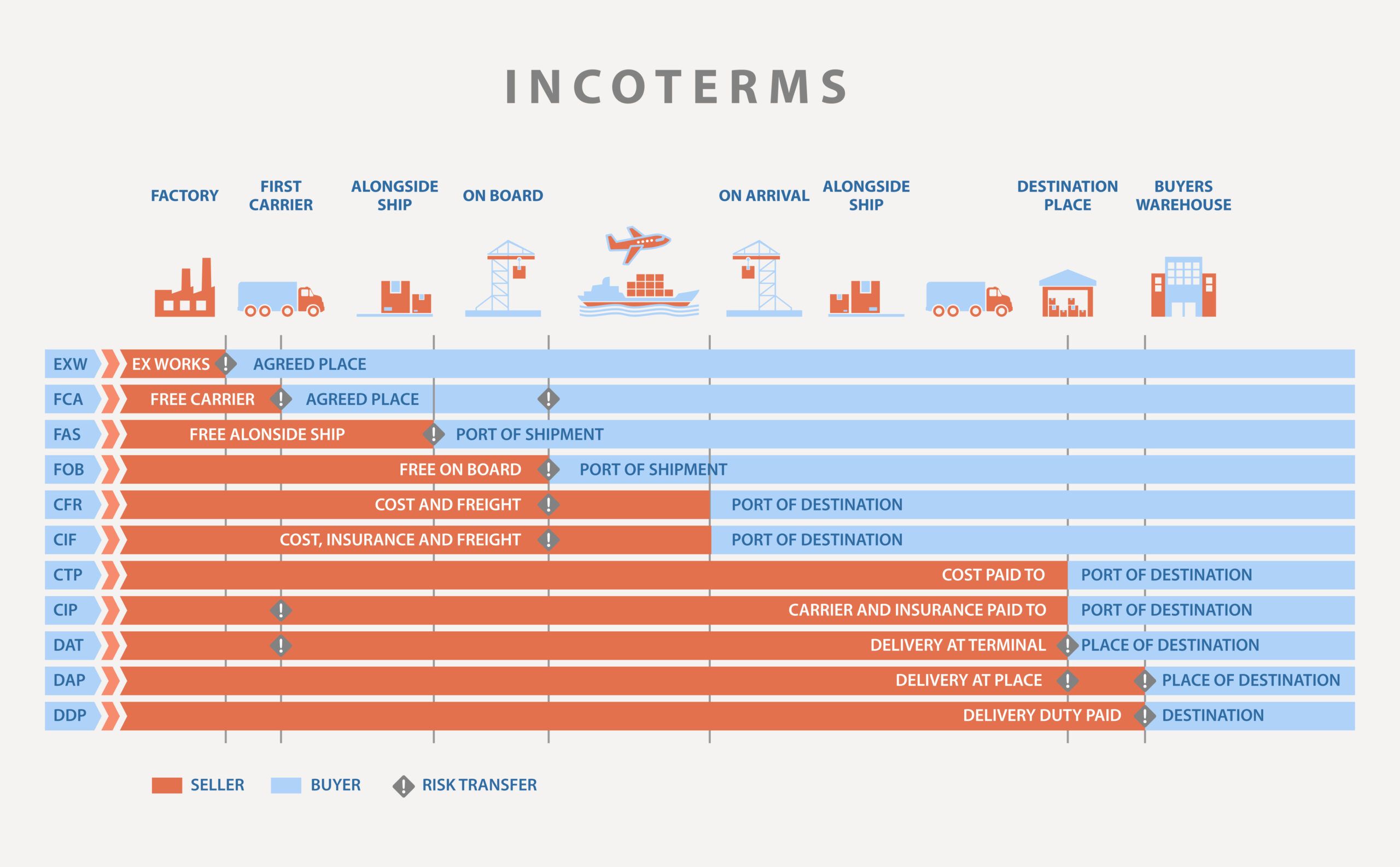

Distribution of costs according to the Incoterm negotiated in the contract. Classification according to the increased level of obligations for the seller.

The most common term (almost 40% of international treaties are drawn up with this rule), because it is universal and easy to use. The best benefits are the use of any type of transport and any place of delivery of goods that is located in the seller’s country. There are 2 points of dispatch:

1. A point of dispatch of goods that belongs to the seller – this can be his warehouse, store, etc. Delivery is considered completed if the goods are loaded on the buyer’s vehicle or transferred to the courier specified by the buyer.

2. A point that does not belong to the seller – it can be a seaport, airport, etc. Delivery is considered completed when the goods have been transferred to the carrier from the seller’s vehicle. Unloading goods from the seller’s vehicle is not the responsibility of the carrier.

If the buyer instructed to give the seller a package of documents (for example, a bill of lading marked “on board” or an air waybill) then the carrier must provide all original consignment notes to the seller.

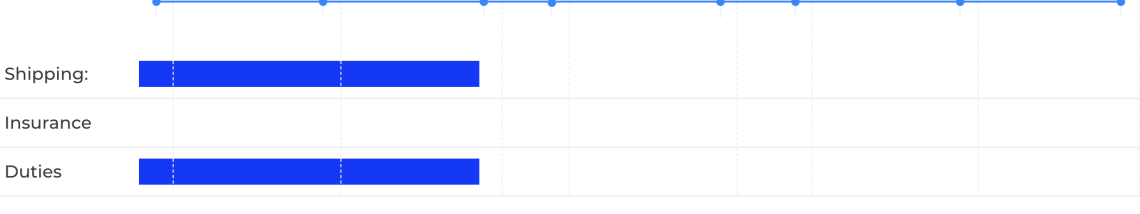

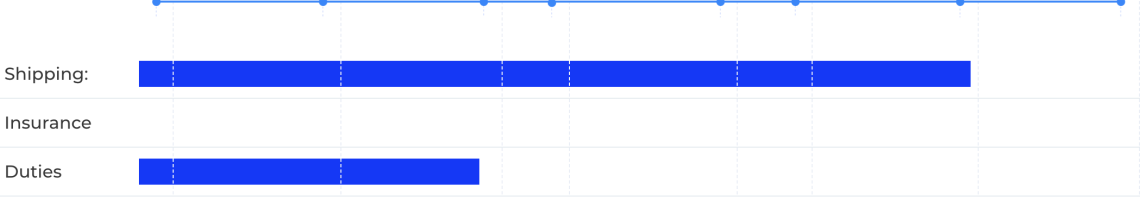

Who covers the logistics charges?

Distribution of costs according to the Incoterm negotiated in the contract. Classification according to the increased level of obligations for the seller.

The meaning of it is that the delivery is completed for the supplier when customs procedures for export were completed, paid insurance policy and the goods were transferred to the forwarder for transportation to a specific destination provided for in the agreement. Sum insured must be 110% of the value of the agreement and in the currency of the international agreement. All risks associated with the transportation of goods pass from supplier to recipient after delivery of the goods to the forwarder. CIP is concluded on the basis of an international contract of sale, which indicates all the responsibilities and what expenses each party bears. As a rule, the supplier bears all responsibilities with the delivery, insurance policy and clearance of goods to a specific destination.

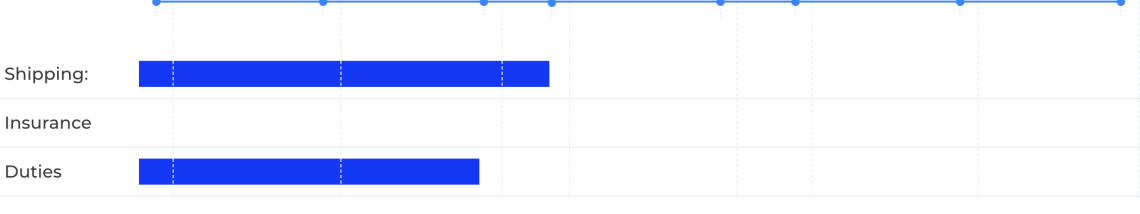

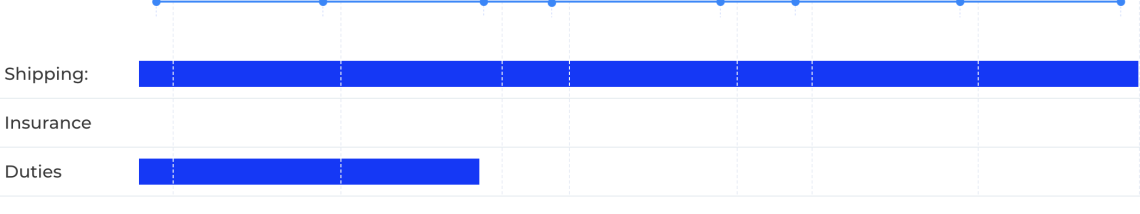

Who covers the logistics charges?

Distribution of costs according to the Incoterm negotiated in the contract. Classification according to the increased level of obligations for the seller.

The meaning of it is that the delivery is completed for the supplier when the product is on the quay for loading on vessel hired by the recipient. FAS is intended only for transporting goods by sea or inland waterway. Supplier pays the export duty, packaging of goods and transportation of cargo to the port, as well as the possible costs of arrival at the port, and provides the relevant documentation. Recipient loads the goods onto the ship, hires and pays the ship, bears all the costs of transporting the goods to the destination, insures the goods, pays import duty, relevant certificates, licenses, etc. FAS is designed to transport goods in bulk or in containers, and also for transportation of heavy equipment.

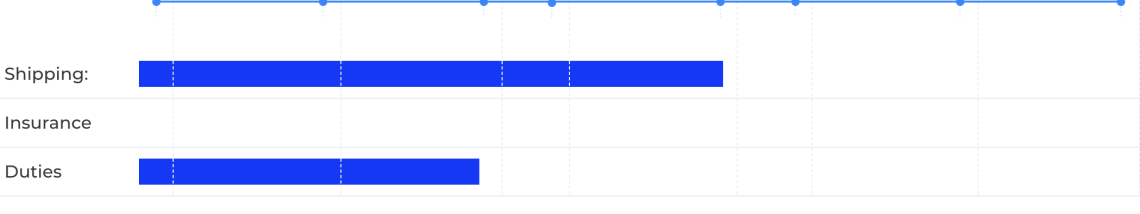

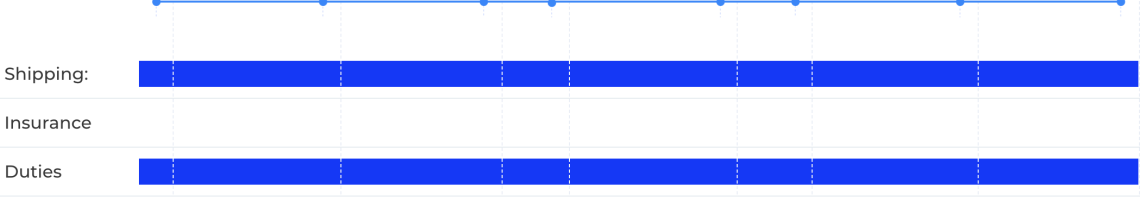

Who covers the logistics charges?

Distribution of costs according to the Incoterm negotiated in the contract. Classification according to the increased level of obligations for the seller.

The meaning of it is that the delivery is completed for the supplier when the product is on board the ship hired by the recipient. FOB is intended only for transporting goods by sea or inland waterway. The responsibilities of the supplier and the recipient are shared equally. Supplier pays export duty, packaging the goods and transportation of the cargo to the port, loads the goods on board and provides the relevant documentation. Recipient hires and pays the ship, insures the goods, pays import duty, relevant certificates, licenses, etc. FOB is designed to transport goods in bulk or in containers, and also for transportation of heavy equipment

Who covers the logistics charges?

Distribution of costs according to the Incoterm negotiated in the contract. Classification according to the increased level of obligations for the seller.

The meaning of it is that the delivery is completed for the supplier when the product is on board the ship hired by the supplier to a port of destination. CFR is intended only for transporting goods by sea or inland waterway. Supplier pays export duty, packaging the goods and transportation of the cargo to the port, loads the goods on board, hires and pays the ship and provides the relevant documentation. Recipient unloads the vessel, delivers the goods to the destination, insures the goods, pays import duty, relevant certificates, licenses, etc. CFR is designed to transport goods in bulk or in containers, and also for transportation of heavy equipment.

Who covers the logistics charges?

Distribution of costs according to the Incoterm negotiated in the contract. Classification according to the increased level of obligations for the seller.

The meaning of it is that the delivery is completed for the supplier when the product came on board the vessel, products have been insured by the supplier, and the vessel was hired by him to transport the goods to the destination port, which is established in the agreement. CIF is intended only for transporting goods by sea or inland waterway. Supplier pays export duty, packaging the goods and transportation of the cargo to the port, loads the goods on board, hires and pays the ship, insures the goods and provides the relevant documentation. Recipient unloads the vessel, pays import duty, relevant certificates, licenses, etc., delivers the goods to the point set in the agreement. CIF is designed to transport goods in bulk or in containers, and also for transportation of heavy equipment.

Who covers the logistics charges?

Distribution of costs according to the Incoterm negotiated in the contract. Classification according to the increased level of obligations for the seller.

The meaning of it is that the delivery is completed for the supplier when the goods are placed at the disposal of the recipient at the indicated place. Supplier must bear all costs for export duties and delivery of goods to the specified destination, including its unloading. Supplier pays for export duty, packaging the goods and transportation of the cargo to the port, loads the products on board, hires and pays the ship, engages in unloading from a ship, and optionally delivers and unloads at the destination. Recipient insures the goods at will, pays import duty, relevant certificates, licenses, etc. DPU is used to transport goods by any means of transport.

Who covers the logistics charges?

Distribution of costs according to the Incoterm negotiated in the contract. Classification according to the increased level of obligations for the seller.

The meaning of it is that the delivery is completed for the supplier when the goods are delivered to the recipient and ready for unloading at the indicated destination. Supplier must pay all export duties and costs for the delivery of the goods to the specified destination, and its unloading. The supplier pays export duty, packages the goods and transportation of the cargo to the port, loads the goods on board, hires and pays the ship, provides the relevant documentation, and also pays for unloading from the ship and delivery to the final destination. The recipient unloads a vehicle on the spot, insures the goods at will, and pays import duty, relevant certificates, licenses, etc. DAP is used to transport goods by any means of transport.

Who covers the logistics charges?

Distribution of costs according to the Incoterm negotiated in the contract. Classification according to the increased level of obligations for the seller.

DDP — Delivered Duty Paid

The meaning of it is that the delivery is completed for the supplier when the goods are delivered to the recipient, import duty is paid and the cargo is ready for unloading at the indicated destination. The DDP clause implies maximum obligations for the shipper, as opposed to the EXW clause, where all shipping responsibilities are placed on the recipient. The recipient assumes only the unloading of goods on the spot and insurance of the goods at will. All other costs are transferred to the supplier (export and import payments, costs of transportation of goods) DDP is used to transport goods by any means of transport.

Who covers the logistics charges?

Distribution of costs according to the Incoterm negotiated in the contract. Classification according to the increased level of obligations for the seller.

Incoterms® Guide to use in 2023

It is important to know which Incoterms® are applicable in 2023 as they determine the responsibilities of buyers and sellers. Additionally, incorrect Incoterms® can result in costly errors or delays in international trade.

Incoterms® were first published in 1936 and are continually updated over time to reflect the changing global business environment to be continually used in 2022 and beyond.

The International Chamber of Commerce ICC published the latest version of Incoterms® 2020. These changes came into effect on the 1st of January 2020 and will be used in 2023 and beyond, until the next changes are published sometime in future. The ICC originally published Incoterms® in 1936 and have continually made updates to reflect the changes to the global trade environment. It’s important that all parties involved in trade clearly understand the changes and how they apply to global supply chains.

Incoterms® play such a vital role in the world of global trade. In 2023, it’s imperative that buyers and sellers clearly understand Incoterms® 2010 or Incoterms® 2020 and clearly understand each party’s obligations along the supply chain.

What are Incoterms®?

Put simply, Incoterms® are the selling terms that the buyer and seller of goods both agree to during international transactions. These rules are accepted by governments and legal authorities around the world. Understanding Incoterms® is a vital part of International Trade because they clearly state which tasks, costs and risks are associated with the buyer and the seller.

The Incoterm® states when the seller’s costs and risks are transferred onto the buyer. It’s also important to understand that not all rules apply in all cases. Some encompass any mode or modes of transport. Transport by all modes of transport (road, rail, air and sea) covers FCA, CPT, CIP, DAP, DPU (replaces DAT) and DDP. Sea/Inland waterway transport (Sea) covers FAS, FOB, CFR and CIF.

Why are Incoterms® vital in International Trade?

Incoterms® are referred to as International Commercial Terms. They are a set of rules published by the International Chamber of Commerce (ICC), which relate to International Commercial Law. According to the ICC, Incoterms® rules provide internationally accepted definitions and rules of interpretation for most common commercial terms used in contracts for the sale of goods.

All International purchases will be processed on an agreed Incoterm to define which party legally incurs costs and risks. Incoterms® will be clearly stated on relevant shipping documents.

An overview of the 11 Incoterms® 2020 rules that can be used in 2023